The JPMorgan Equity Premium Income ETF (JEPI) is a actively managed exchange-traded fund (ETF) that seeks to provide investors with income and capital appreciation by investing in a diversified portfolio of U.S. equity securities. The ETF invests in a variety of asset classes, including large-cap, mid-cap, and small-cap stocks, as well as dividend-paying stocks. JEPI also invests in options on equity indexes, which can help to generate income and reduce volatility.

The JEPI stock chart is a valuable tool for investors who want to understand the performance of the ETF. The chart shows the ETF’s historical price movements, as well as its performance relative to other market benchmarks.

JEPI Stock Chart: Historical Performance

The JEPI stock chart shows that the ETF has been a solid performer over its history. The ETF has generated an average annual return of 12.8% since its inception in 2020. This is significantly higher than the average annual return of the S&P 500 index, which is 10.5%.

JEPI Stock Chart: Sector Breakdown

The JEPI stock chart also shows that the ETF is well-diversified across different sectors. The top 10 holdings of the ETF are Microsoft Corporation (MSFT), Adobe Inc. (ADBE), Amazon.com, Inc. (AMZN), Progressive Corporation (PGR), Intuit Inc. (INTU), Mastercard Incorporated (MA), Trane Technologies plc (TT), Accenture plc Class A Ordinary Shares (Ireland) (ACN), Visa Inc. (V), and UnitedHealth Group Incorporated (UNH). These companies are all leaders in their respective industries, and they are all well-positioned for future growth.

JEPI Stock Chart: Options Strategy

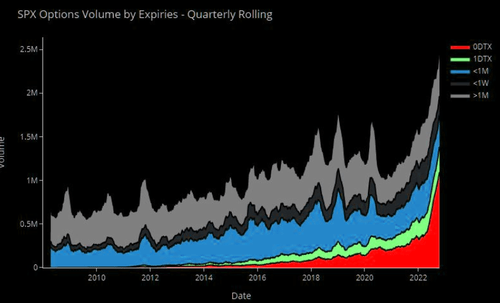

One of the key features of JEPI is its use of options on equity indexes. The ETF uses options to generate income and reduce volatility. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a certain price by a certain time.

By using options, JEPI can generate income in two ways. First, the ETF can sell options to collect premium income. Second, the ETF can buy options to reduce its exposure to stock market volatility. By using options effectively, JEPI can improve its overall return and risk profile.

JEPI Stock Chart: Comparing to Alternatives

JEPI is often compared to other dividend-paying ETFs, such as the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM). These ETFs all invest in a mix of dividend-paying stocks, but they differ in their investment strategies and fees.

JEPI is a more actively managed ETF than SCHD and VYM. This means that JEPI’s portfolio manager has more discretion in selecting which stocks to invest in. However, it also means that JEPI’s fees are higher than SCHD and VYM.

Overall, JEPI is a solid choice for investors who are looking for a way to generate income and capital appreciation. The ETF has a strong track record of performance, and it is well-diversified across different sectors. Additionally, JEPI’s use of options can help to improve its overall return and risk profile.

JEPI Stock Chart: Risks

As with any investment, there are risks associated with investing in JEPI. The ETF’s performance is tied to the performance of the stock market, and it is also exposed to the risk of options trading. Additionally, JEPI’s fees are higher than other dividend-paying ETFs.

Conclusion

The JEPI stock chart is a valuable tool for investors who want to understand the performance of the ETF. The chart shows that JEPI has been a solid performer over its history, and it is well-diversified across different sectors. However, investors should be aware of the risks associated with investing in the ETF.